Marketing & Sales

Beyond Defense: The Sales Coverage Gap Holding HVACR Distributors Back

November 26, 2025 | 6 minute read

Mike Marks, Indian River Consulting Group, will share the results of a recent study on the future of sales in the HVACR channel and moderate a panel at our upcoming Annual Conference. The session, “Myths & Misperceptions Revisited: The Next 10 Years of Sales, Service & Value,” will be at 10:45 a.m. on Tuesday, Dec. 9. This article is a preview of that session.

Even as loyalty declines and customers become more independent, many HVACR distributors are still struggling to gain meaningful share. Sales teams remain focused on protecting the business they have.

But that defensive posture comes at the expense of capturing new opportunities.

When IRCG first studied market creation with HARDI members in 2018, we found that roughly 90% of business each year stayed with the same distributor. Switching was rare. But when switching did occur, it was four times more likely to be triggered by what we call a Critical Selling Event (CSE) – an external disruption that pushes a customer to reconsider their current supplier – than by any deliberate selling effort.

In other words, most distributors weren’t losing business because competitors were outselling them. They were losing it in the moments when their customers’ situation changed, and no one noticed. They were also failing to capture business when their competitors’ customers unexpectedly looked for other options.

What the Data Shows: Limited Coverage, Lost Opportunity

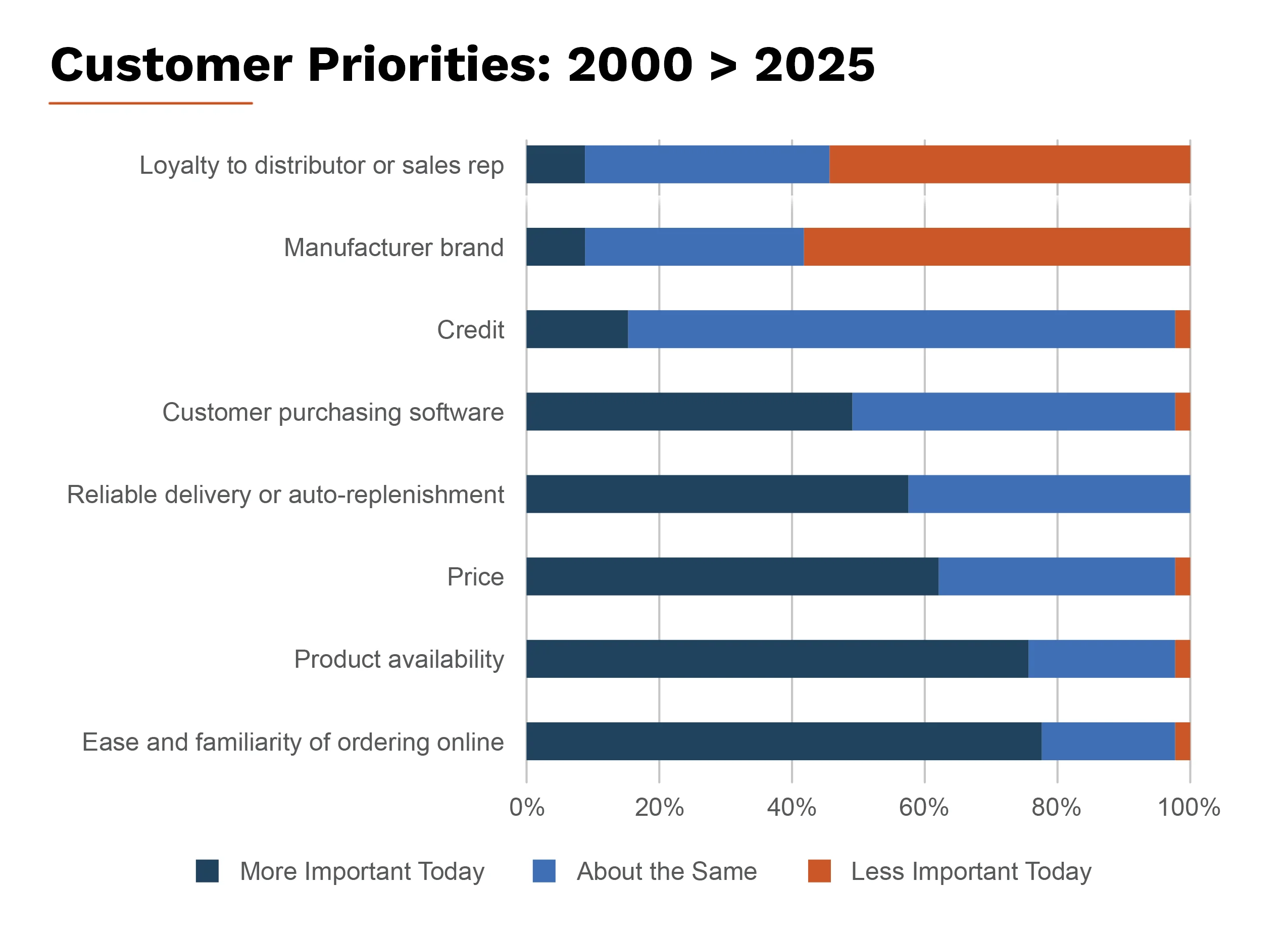

Eight years later, the fundamental pattern remains, but the willingness to change has increased. In our recent HARDI member research, most survey respondents told us that loyalty to distributor and brand has decreased over the past five years.

Respondents were clear that the two things that have changed most in the past eight years are loyalty to distributor/sales rep and loyalty to brand.

If anything, the industry is still experiencing a large number of CSEs from a supply chain that is still fragile; the refrigerant changes have only added to the chaos.

Yet instead of proactively expanding coverage to capture more CSEs, many have shifted inward, pouring energy into avoiding their own self-inflicted CSEs:

Prevent stockouts

Contain service failures

Manage material and refrigerant transitions

These matter but only protect the business you already have. Winning more requires seeing more. Most distributors simply don’t have the coverage needed to intercept CSEs as they happen.

The numbers tell the story:

Generally, more than half of field sales calls by TSMs go to less than 10% of their assigned customers.

Less than half of participants in the HARDI survey have intentionally emphasized remote customer touches – even though doing so expands sales capacity.

Most HARDI distributors have a CRM yet call budgeting and call logging are among the least adopted practices.

Only 40% of HARDI distributors formally review rep performance monthly. This was established years ago as an NAW best practice related to share growth.

TSMs are overserving a small share of customers and leaving a lot of opportunity unmonitored. In other words, when a competitor causes a CSE, there may not be anyone watching.

Why It Happens: Route Mentality

Most field sales reps are self-directed. They decide where to go, who to see, and how to spend their time. Over years, this creates comfortable routes: a handful of top accounts, visited on predictable schedules, regardless of opportunity.

The pandemic briefly broke this pattern. Remote engagement increased contact frequency and efficiency. But once travel resumed, reps’ behavior reverted, even as buyers embraced faster, digital-first interaction.

Today’s buyers are less loyal and more independent, but coverage still assumes a pre-2020 world.

This creates a widening gap: Coverage has not kept pace with how the market now buys. This has limited distributors’ ability to see and capture growth from CSEs.

The Management Gap

Technology alone can’t fix Route Mentality. Despite having the infrastructure via a CRM to track activity and surface opportunity, the discipline required to use that information to drive behavior has been less consistent.

The missing discipline: call budgeting (deciding ahead of time where to spend time) vs. call logging (tracking what already happened). This requires a transition from reactive to intentional for time investments. In many companies, pipeline reporting has replaced performance coaching. Activity visibility may have increased, but time allocation remains self-directed.

The gap isn’t motivation; field sales reps want to do well. It’s prioritization. The distributors seeing the strongest coverage results have managers and reps planning how limited selling time will be deployed — aligning effort with opportunity. The leverage is that they get back to their plan quickly after the inevitable interruptions.

When reps strategically plan their time, they can rebalance effort across the full customer base. For many HARDI member this will be the Moneyball play for revenue growth.

Moving from Defense to Offense

HARDI distributors need to rethink how their sales team spends their time. Consider what sales reps should prioritize, the balance of remote vs. in-person calls, frequency of contact and amount of time spent intercepting CSEs.

For most distributors, this will look like:

Rebalancing time — Reduce routine in-person visits to top accounts; shift capacity to emerging and overlooked customers. Let outside sales reps focus on opportunities to intercept high-value CSEs than just retaining existing business.

Redesigning roles — Hybrid and proactive inside sales expand reach and prevent and intercept CSEs without adding headcount. Many survey participants have made investments in these specialized roles, which are amplifiers of coverage.

Redefining management — Quarterly call budgeting conversations align effort with opportunity and reinforce accountability.

Reframing incentives — Pay for profitable growth beyond the top 10 accounts, where most untapped potential lives. You could also target or disproportionately emphasize incentive pay on new business, such as customers or categories currently served by a competitor.

CSEs create rare moments when customers are willing to change their behavior, but those moments aren’t visible without the right coverage model. As we found in our original research, to gain exposure to a competitor’s customers who are having a CSE, two things must happen:

They must experience an external event (out of your control) that causes them to look outside their current supplier.

Most importantly, they must think of you as a potential substitute. Infrequent field sales calls can keep you top of mind.

Distributors need to rethink how selling time is deployed. After all, competitors are just a click or fulfillment delay away. Distributors who continue to play defense will protect what they have, until they don’t. Those who redesign coverage for growth will convert market disruption into market share.

Playing to win today means showing up when it matters most.

Mike Marks

Mike Marks co-founded Indian River Consulting Group in 1987 after 20+ years in distribution management. Specializing in B2B channel-driven markets, he has built strong executive relationships across construction, industrial, OEM, agricultural, and healthcare sectors. Mike has led projects improving market access for manufacturers, dealers, and distributors of all sizes and ownership structures. A respected author, speaker, and board member, he has served as a Research Fellow with NAW, faculty at Purdue, and adjunct faculty at Texas A&M. Formerly EVP at Lex Electronics, Mike is also a championship race car driver, winning the SCCA Endurance Series in 2021 in an SRF3.

You might be interested in...